If you’ve been wrestling with the conundrum of how to record bank deposits in QuickBooks Online, you’re not alone.

Many small businesses struggle with the nuances of managing their financial transactions within this popular accounting software.

Accept it, this issue with bank deposits can cause untold headaches and hamper your efficiency. But don’t worry, we’ve got you covered.

This blog post promises to untangle this issue for you. We’ll provide a comprehensive guide, brimming with simple steps to accurately record your bank deposits in QuickBooks Online.

By offering an overview of our solution, we prove our commitment to helping you navigate this accounting obstacle.

Indeed, these bank deposits quandaries can be frustrating. But imagine a situation where recording every deposit becomes second nature, where you are no longer lost in the labyrinth of financial entries.

That’s precisely what we aim to provide through this blog post – a practical guide that turns your pain point into a point of ease.

We’re here to assist you in mastering the art of recording bank deposits and in doing so, amplify the potential of your business.

Understanding QuickBooks Online

Importance of Correctly Recording Bank Deposits

The bedrock of sound financial management in any business lies in the accurate recording of bank deposits.

Picture it as a jigsaw puzzle; one misplaced piece and the entire picture becomes distorted. The same goes for recording bank deposits.

If they’re recorded inaccurately, your financial picture will be skewed, resulting in flawed reporting and potential business mishaps.

QuickBooks Online offers a dynamic platform for managing these deposits. When used correctly, it can streamline your bookkeeping process.

It’s about turning tedious tasks into a smooth operation, ensuring the gears of your business machine run flawlessly.

Overview of QuickBooks Online for First-time Users

For newcomers, QuickBooks Online might seem daunting. However, much like learning to drive a car, practice and understanding make it second nature.

It’s a cloud-based accounting software designed to manage invoices, track sales, and handle aspects of bookkeeping including bank deposits.

In the heart of QuickBooks Online, you’ll find a feature-packed dashboard. It provides a visual summary of your business’s financial health at a glance.

It’s your command center, from where you’ll manage all your financial transactions, including recording bank deposits.

Step-by-Step Guide: Recording Bank Deposits in QuickBooks Online

Preparing to Record Bank Deposits

Before you start recording bank deposits, ensure all relevant transactions are up to date. Think of it as setting the stage before the grand performance.

This includes verifying the accuracy of invoice payments and sales receipts in QuickBooks Online.

You want a clean slate, ensuring there are no discrepancies that could cause confusion.

The aim is to avoid the ‘mystery deposit’ scenario, where a deposit cannot be matched to any transaction in the system.

How to Record Bank Deposits: A Detailed Walkthrough

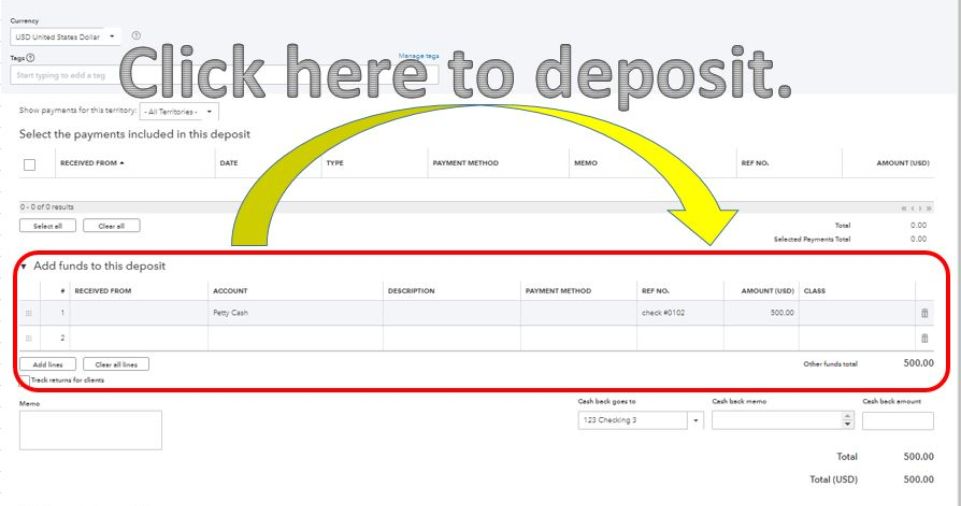

Let’s dive into the process. From the dashboard, navigate to the banking menu. Select ‘Make Deposits’. Here, you’ll enter your bank deposit details.

It’s like filling out an online form, but in this case, the fields pertain to your financial information.

Continue by selecting the payments to deposit from the list of available payments. It’s akin to choosing ingredients for a recipe.

You only want to include what’s needed. Once completed, save and close.

Common Mistakes to Avoid when Recording Bank Deposits

While recording bank deposits, it’s easy to make errors. One common misstep is recording deposits twice.

It’s like double-dipping a chip, it results in an inflated bank balance.

Another common mistake is not matching deposits with the correct invoice.

It’s akin to pairing the wrong socks together, causing mismatched financial records.

Tips and Tricks for Efficiently Handling Bank Deposits in QuickBooks Online

Expert Tips for a Smoother Experience

Regularly reconcile your QuickBooks Online with bank statements. It’s like cross-checking your shopping list with what you’ve bought.

This habit ensures your recorded bank deposits align with your actual bank balance.

Don’t ignore discrepancies. Addressing these immediately is akin to plucking a thorn from your foot. It prevents further discomfort or issues down the line.

How to Manage Bank Deposits Effectively

Schedule a regular review of your bank deposits. Think of it as a routine health check-up, but for your business finances.

Regular reviews ensure any discrepancies are caught and rectified promptly.

Set reminders to record your bank deposits immediately after transactions.

It’s like setting an alarm to wake up on time, preventing you from missing anything important.

Case Study: Successful Bank Deposit Management in QuickBooks Online

Example of Successful Bank Deposit Management

Consider the case of a local retailer, Jane’s Boutique. Initially, Jane struggled with managing bank deposits in QuickBooks Online.

After a dedicated effort to understand the system, she began recording accurately.

Jane embraced the steps and tips we’ve discussed above, and as a result, she transformed her bookkeeping from a frustrating task to a seamless process.

Lessons Learned and How to Apply Them

Jane’s Boutique stands as a testament to effective bank deposit management. The takeaway?

Grasp the basics, maintain accuracy, and adopt best practices for managing bank deposits in QuickBooks Online.

With these lessons applied, your financial management can run as smoothly as Jane’s.

Conclusion

In the great orchestra of business, the accurate recording of bank deposits in QuickBooks Online plays a pivotal role.

It’s a key instrument in harmonizing your financial melody. We’ve delved into understanding QuickBooks Online, explored a step-by-step guide on how to record bank deposits, and highlighted common mistakes to avoid.

With the expert tips provided, the process of managing bank deposits should now feel less like navigating a maze and more like a straight path.

Remember, practice makes perfect, and mastering a new skill requires patience and perseverance.

Our case study of Jane’s Boutique showed us that successful bank deposit management is achievable.

Her story assures us that with the right knowledge and practices, you too can manage your bank deposits effectively. So, gear up and dive in.

Turn your QuickBooks Online into a powerful tool to strengthen your business’s financial management.

Let’s turn your struggles into success stories!

FAQs

Q: What is QuickBooks Online?

A: QuickBooks Online is a cloud-based accounting software designed to help businesses manage their finances, including tracking sales, creating and sending invoices, and recording bank deposits.

Q: Why is it essential to correctly record bank deposits in QuickBooks Online?

A: Correctly recording bank deposits ensures that your business’s financial reports are accurate. Mismanaged bank deposits can lead to an inflated or underestimated bank balance, leading to inaccurate financial forecasting.

Q: How can I avoid common mistakes when recording bank deposits in QuickBooks Online?

A: Some common mistakes include double recording of deposits and not matching deposits with the correct invoice. Regularly reconciling your QuickBooks Online with bank statements and setting reminders to record your bank deposits immediately after transactions can help avoid these errors.

Q: Where can I find expert tips for handling bank deposits in QuickBooks Online?

A: Our blog post provides expert tips for handling bank deposits efficiently in QuickBooks Online. It’s a comprehensive guide with a step-by-step process, common mistakes to avoid, and a case study for successful bank deposit management.

Q: Can I successfully manage bank deposits in QuickBooks Online even if I’m a beginner?

A: Absolutely! QuickBooks Online is designed to be user-friendly. With our guide, a beginner can learn to manage bank deposits effectively. Like driving a car or riding a bike, it’s all about understanding the process and practicing regularly.